Onchain Tokenomics: The Future Of Digital Economies

Onchain tokenomics is more than just a buzzword in the world of blockchain and cryptocurrencies. It represents a fundamental shift in how we think about value creation, distribution, and sustainability in digital ecosystems. Imagine a world where every transaction, every decision, and every reward is transparently recorded on a blockchain. That's the power of onchain tokenomics at play. In this article, we'll dive deep into what onchain tokenomics is, why it matters, and how it's shaping the future of decentralized finance (DeFi) and beyond.

As the crypto space evolves, understanding onchain tokenomics becomes crucial for anyone looking to navigate this complex yet fascinating landscape. Whether you're a developer, investor, or simply someone curious about blockchain technology, this article will provide you with the insights you need to grasp the concept fully. We'll explore its mechanisms, benefits, and challenges while offering practical advice on how to leverage it effectively.

So, buckle up! This journey into onchain tokenomics will take you through the ins and outs of token design, governance models, and real-world applications. By the end of this article, you'll have a solid foundation to make informed decisions about your involvement in the crypto ecosystem. Let's get started!

Read also:Choline The Unsung Hero Of Holistic Health

Table of Contents

- What is Onchain Tokenomics?

- Why Does Onchain Tokenomics Matter?

- Key Components of Onchain Tokenomics

- Designing Effective Token Models

- Onchain vs Offchain Tokenomics

- Real-World Applications of Onchain Tokenomics

- Challenges and Solutions in Onchain Tokenomics

- Future Trends in Onchain Tokenomics

- Data and Statistics on Onchain Tokenomics

- Conclusion: Embracing the Power of Onchain Tokenomics

What is Onchain Tokenomics?

Onchain tokenomics refers to the economic principles and mechanisms governing the creation, distribution, and management of tokens within a blockchain ecosystem. Unlike traditional financial systems, onchain tokenomics operates on a decentralized ledger, ensuring transparency, security, and immutability. This means every transaction, supply adjustment, and incentive mechanism is recorded on the blockchain, making it accessible to all participants.

At its core, onchain tokenomics is about designing token models that align with the goals of the ecosystem. Whether it's incentivizing user participation, rewarding developers, or ensuring long-term sustainability, the token model must be carefully crafted to achieve these objectives. This involves considerations such as token supply, inflation rates, staking mechanisms, and governance structures.

For instance, a well-designed onchain tokenomics model might include features like deflationary mechanisms to reduce token supply over time, creating scarcity and potentially increasing value. Or it could incorporate liquidity mining programs to encourage users to provide liquidity to decentralized exchanges (DEXs). The possibilities are endless, but the key lies in striking the right balance between supply and demand.

Why Onchain Tokenomics is Different

One of the main differences between onchain and traditional tokenomics is the level of transparency. With onchain tokenomics, all activities are recorded on the blockchain, making it easier for stakeholders to verify and audit the system. This transparency builds trust and accountability, which are essential in any financial ecosystem.

Additionally, onchain tokenomics often leverages smart contracts to automate processes such as token distribution, vesting schedules, and reward mechanisms. This reduces the need for intermediaries, lowers costs, and increases efficiency. As a result, onchain tokenomics is becoming increasingly popular in decentralized applications (dApps) and blockchain networks.

Why Does Onchain Tokenomics Matter?

In today's rapidly evolving digital economy, onchain tokenomics plays a crucial role in driving innovation and growth. By providing a transparent and decentralized framework for managing tokens, it enables the creation of new business models and revenue streams. For example, onchain tokenomics has been instrumental in the rise of DeFi platforms, NFT marketplaces, and play-to-earn games.

Read also:Latvius Was The Son Of Which Apostle Unraveling The Biblical Mystery

Moreover, onchain tokenomics helps address some of the key challenges facing traditional financial systems, such as lack of transparency, high transaction costs, and limited accessibility. By leveraging blockchain technology, it offers a more inclusive and efficient alternative that can benefit a wider range of participants.

For investors, understanding onchain tokenomics is essential for making informed decisions. It allows them to evaluate the potential value and sustainability of a project based on its token design and economic model. This, in turn, can lead to better investment outcomes and reduced risks.

Key Components of Onchain Tokenomics

Now that we've established what onchain tokenomics is and why it matters, let's take a closer look at its key components. These components form the backbone of any successful tokenomics model and must be carefully designed to ensure the long-term viability of the ecosystem.

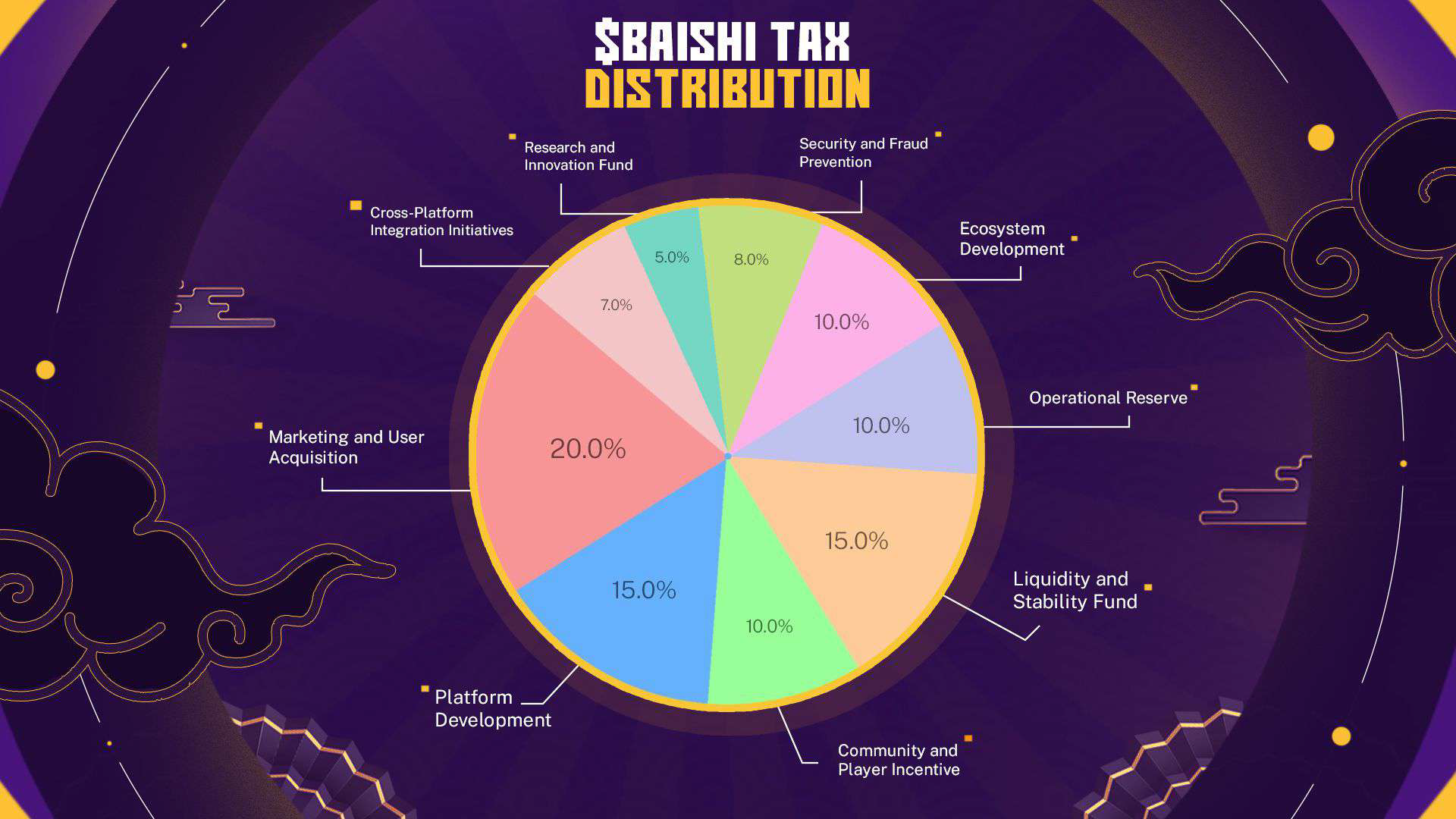

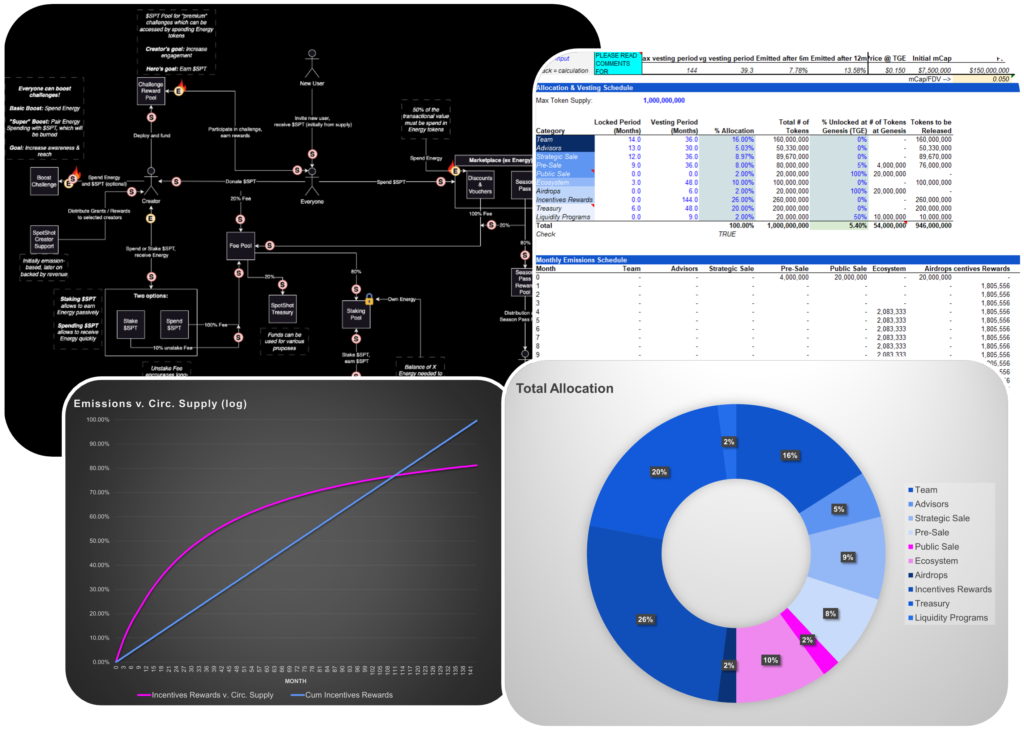

Token Supply and Distribution

One of the most critical aspects of onchain tokenomics is token supply and distribution. This involves determining the total supply of tokens, how they will be distributed, and any mechanisms for adjusting supply over time. For example, some projects may opt for a fixed supply to create scarcity, while others may implement inflationary models to reward long-term participants.

Token distribution can take many forms, including initial coin offerings (ICOs), initial DEX offerings (IDOs), airdrops, and liquidity mining programs. Each method has its own advantages and disadvantages, and the choice often depends on the project's goals and target audience.

Governance Mechanisms

Another important component of onchain tokenomics is governance. Governance refers to the process by which decisions are made within the ecosystem, such as protocol upgrades, parameter adjustments, and treasury management. In onchain tokenomics, governance is typically achieved through token-based voting systems, where token holders can propose and vote on changes to the protocol.

This decentralized approach to governance ensures that the ecosystem remains community-driven and responsive to the needs of its participants. It also promotes transparency and accountability, as all governance activities are recorded on the blockchain for everyone to see.

Reward Systems

Reward systems are another key aspect of onchain tokenomics, designed to incentivize user participation and contribute to the growth of the ecosystem. These systems can take various forms, such as staking rewards, liquidity mining incentives, and referral bonuses.

For example, staking rewards encourage users to lock up their tokens in exchange for additional tokens, helping to secure the network and increase its value. Liquidity mining programs, on the other hand, reward users for providing liquidity to decentralized exchanges, enabling smoother and more efficient trading.

Designing Effective Token Models

Designing an effective onchain token model requires careful consideration of various factors, including the project's goals, target audience, and competitive landscape. Here are some tips to help you create a token model that aligns with your vision:

- Define clear objectives: What do you want to achieve with your token? Is it to raise funds, incentivize users, or create a store of value? Your objectives will guide the design of your token model.

- Understand your audience: Who are your target users, and what motivates them? Tailoring your token model to meet the needs of your audience can increase adoption and engagement.

- Balance supply and demand: Ensure that your token supply and distribution mechanisms are designed to maintain a healthy balance between supply and demand, preventing price volatility and ensuring long-term sustainability.

- Integrate governance and reward systems: Incorporate robust governance and reward systems to incentivize user participation and drive the growth of your ecosystem.

Onchain vs Offchain Tokenomics

While onchain tokenomics operates on a blockchain, offchain tokenomics refers to token models that are managed outside of the blockchain. The main difference between the two lies in transparency and decentralization. Onchain tokenomics offers greater transparency and security, as all activities are recorded on the blockchain, whereas offchain tokenomics relies on centralized entities to manage and verify transactions.

However, offchain tokenomics can offer faster and cheaper transactions, making it suitable for certain use cases such as micropayments or high-frequency trading. Ultimately, the choice between onchain and offchain tokenomics depends on the specific needs of the project and its participants.

Hybrid Approaches

Some projects are exploring hybrid approaches that combine the benefits of both onchain and offchain tokenomics. For example, they might use onchain mechanisms for critical activities such as governance and token distribution while relying on offchain solutions for everyday transactions. This approach can provide the best of both worlds, offering transparency and security where it matters most while maintaining speed and efficiency for everyday use.

Real-World Applications of Onchain Tokenomics

Onchain tokenomics is already being used in a variety of real-world applications across different industries. Here are some examples:

Decentralized Finance (DeFi)

DeFi platforms such as Uniswap, Aave, and Compound have revolutionized the financial industry by offering decentralized lending, borrowing, and trading services. These platforms rely on onchain tokenomics to incentivize liquidity providers, reward users, and ensure the stability of their protocols.

Non-Fungible Tokens (NFTs)

NFTs have taken the art and entertainment industries by storm, enabling creators to monetize their digital assets in new and innovative ways. Onchain tokenomics plays a crucial role in NFT ecosystems by providing a transparent and secure framework for buying, selling, and trading digital assets.

Play-to-Earn Games

Play-to-earn games like Axie Infinity and The Sandbox have introduced a new paradigm in gaming, where players can earn real-world rewards by participating in the game. Onchain tokenomics ensures that these rewards are distributed fairly and transparently, creating a more engaging and rewarding experience for players.

Challenges and Solutions in Onchain Tokenomics

While onchain tokenomics offers many benefits, it also comes with its own set of challenges. Here are some of the most common challenges and potential solutions:

Volatility

One of the biggest challenges in onchain tokenomics is price volatility, which can make it difficult for users to predict the value of their tokens. To address this issue, projects can implement mechanisms such as token bonding curves, treasury management, and reserve funds to stabilize token prices and reduce volatility.

Scalability

Another challenge is scalability, as blockchain networks can struggle to handle large volumes of transactions. To overcome this, projects can explore layer-2 solutions, sidechains, or hybrid approaches that combine onchain and offchain mechanisms to improve scalability without sacrificing security or transparency.

Future Trends in Onchain Tokenomics

The future of onchain tokenomics looks bright, with several emerging trends set to shape the landscape in the coming years. Here are some of the most promising trends:

- Interoperability: As more blockchain networks and protocols emerge, interoperability will become increasingly important, enabling seamless communication and collaboration between different ecosystems.

- Sustainability: With growing concerns about the environmental impact of blockchain technology, projects are exploring more sustainable tokenomics models that reduce energy consumption and carbon emissions.

- Regulation: As governments around the world begin to regulate the crypto space, onchain tokenomics will need to adapt to ensure compliance while maintaining its core principles of transparency and decentralization.

Data and Statistics on Onchain Tokenomics

To give you a better understanding of the impact of onchain tokenomics, here are some key data and statistics:

- As of 2023, the global DeFi market is valued at over $100 billion, with onchain tokenomics playing a crucial role in its growth and development.

- NFT sales reached $25 billion in 2021, highlighting the potential of onchain tokenomics in the digital art and entertainment industries.

- Play-to-earn games have attracted millions of players worldwide, with some earning as much as $1,000 per month through onchain tokenomics mechanisms.

Conclusion: Embracing the Power of Onchain Tokenomics

In conclusion, onchain tokenomics represents a powerful tool for creating value, driving innovation, and building sustainable ecosystems in the digital age. By understanding its principles and mechanisms, you can harness its potential to achieve your goals and contribute to the growth of the crypto space.